1. Qujing Defang has an annual output of 110,000 tons of new phosphate-based cathode materials put into production

On the morning of September 19, 2022, the production base project of Qujing Defang Nano Technology Co., Ltd. with an annual output of 110,000 tons of new phosphate-based cathode materials was officially put into operation in Qujing, Yunnan. The project started construction in January 2022, and will be completed and put into production in September 2022. It is currently the lithium manganese iron phosphate cathode material project with the largest monomer production capacity in the country. The official commissioning of the project means that Defang Nano has taken the lead in the lithium manganese iron phosphate market, which will strongly drive the innovation and development of the new energy industry chain.

2. In August, Sichuan, Chongqing and other places suffered power cuts, and the output of some enterprises declined

In August 2022, Sichuan, Chongqing, Anhui and other places suffered from severe electricity consumption, and some lithium iron phosphate enterprises were forced to stop production. Enterprises whose production declined that month included Hunan Yuneng, Chongqing Terui, Guoxuan Hi-Tech, Jiangxi Shenghua, Changzhou Lithium Yuan, Jintang era, etc.

3. In November, CATL invited bids for lithium iron phosphate, and most leading companies won the bids

In November 2022, CATL will invite bids for the purchase demand of lithium iron phosphate in the next three years from 2023 to 2025. Hunan Yuneng, Defang Nano, Wanrun New Energy, Changzhou Liyuan, Shengvana Technology, Jiangxi Shenghua, Chongqing Special Rui and other top lithium iron phosphate companies have won the bid.

4. In December, Changzhou Liyuan and BYD invited bids for iron phosphate

In December 2022, Changzhou Liyuan and BYD will invite bids for the procurement demand of iron phosphate in 2023, opening a new mode of procurement, sales and pricing for the iron phosphate industry.

5. In 2022, a total of 6 lithium iron phosphate companies are seeking or have successfully listed

In 2022, a total of 6 companies including Hunan Yuneng, Wanrun New Energy, Rongtong Hi-Tech, Anda Technology, Chongqing Terui, and Jiangxi Zhili are seeking or have successfully landed in the capital market. Among them, on the first day of listing, the share price of Wanrun New Energy opened at 249.99 yuan, which is the second highest issue price of new shares in A-share history.

6. Ganfeng Lithium and Fulin Seiko jointly build a lithium dihydrogen phosphate project

On the evening of September 1, Ganfeng Lithium Industry and Fulin Precision Industry disclosed the “marriage” announcement. The two parties will jointly invest in the establishment of a joint venture company and build a new integrated project with an annual output of 200,000 tons of lithium dihydrogen phosphate. The above-mentioned projects will be implemented in phases, with a production capacity of 30,000 tons per year in the first phase, and the target company will further expand the production scale in a timely manner according to market demand in the later stage. Ganfeng Lithium Industry guarantees the supply of lithium sulfate to the target company, and the target company’s products meet the procurement needs of Fulin Precision or its affiliated companies.

7. BYD Wang Chuanfu: Adhere to the strategic direction of lithium iron phosphate

On September 23, Wang Chuanfu, chairman of BYD, said in a public speech that to adhere to the correct strategic direction of lithium iron phosphate, domestic lithium resources can meet the electrification of 300 million vehicles. In order to solve the problem of shortage of mineral resources, Wang Chuanfu proposed that in addition to maintaining the technical route of lithium iron phosphate, the parallel development of pure electric and hybrid power models should also be adhered to.

8. High gross profit and high growth attract a large number of enterprises to deploy lithium iron phosphate

According to ICC Xinyu information statistics, the average gross profit rate of the lithium iron phosphate market is over 25%, which is at a historical high, which has also attracted a large number of enterprises to deploy lithium iron phosphate. By the end of 2022, the total production capacity of lithium iron phosphate will reach 2.4 million tons, and the planned total production capacity will reach 15 million tons, with 101 enterprises deployed.

9. More and more battery factories and car factories are directly deploying lithium iron phosphate

In addition to the existing CATL, BYD, and Guoxuan Hi-Tech, since 2022, battery factories and car factories including Yiwei, Geely Group, Sunwoda, Honeycomb, and Zhongxinhang will directly deploy iron phosphate through equity participation or wholly-owned methods Lithium project.

10. In 2022, new cross-border forces will usher in a major explosion in production capacity

2022 is the year when the production capacity of cross-border new forces such as phosphorus chemical industry, titanium dioxide, and ternary materials will explode. At present, companies that have ignited trial production or batch shipments include Xinyangfeng, Longbai Group, Yuntianhua, and Chuanheng. , Yunxiang Juneng, Yuntu Holdings, Batian Shares, Zhongwei Shares, Changyuan Lithium, etc.

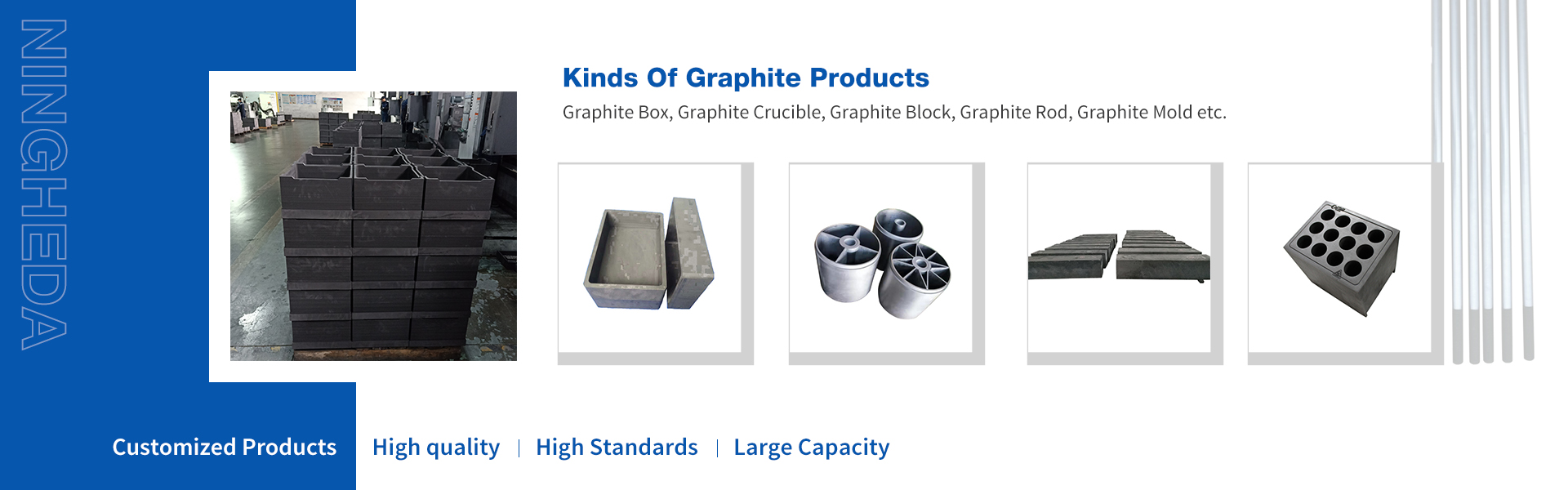

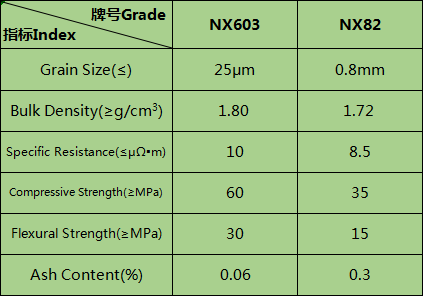

Jiangxi Ningheda, as an excellent supplier of many well-known lithium battery companies, provides customers with high-quality graphite saggers, and based on customer requirements, provides various grades of graphite for customers to choose from. There are grades which are most popular selected by our customers, welcome to contact us if any demand of graphite sagger.

Post time: Dec-28-2022